How about this, a man in New York has been operating a $40 million Ponzi scheme for 31 years. This is a mini-Madoff except that Madoff only lasted 20 years, and Philip Barry, 52, ran the scam without detection for 31 years. He invested the money in real estate and a mail order porn business.

What’s interesting, in both Madoff and Barry’s downfall was the economy. Even more interesting if you can call it that, both were never caught by SEC, but turned themselves in. In both cases, the downfall of the economy led to the downfall of their Ponzi schemes. Money started to run out, so they turned themselves in. What, no money, they develop a conscience?

Prosecutors said that Mr. Barry started his scam in 1978. Bernard Madoff’s $65 billion scam ran for at least 20 years. He was jailed in June for 150 years.

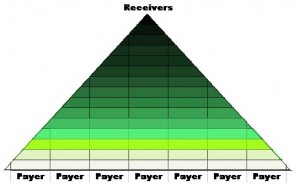

Investigators said they learned of the scheme when Barry turned up at the U.S. Attorney’s office in Manhattan in August of 2008 and asked to speak to a prosecutor. They said Barry acknowledged that, for years, he had been paying off his guaranteed profits by taking money from some customers to cover withdrawals made by others.

Working from a small office in the Brooklyn neighborhood of Bay Ridge, far from the city’s financial center, Barry claimed to be investing in stock options and guaranteed his neighborhood clients solid returns.

But in reality, investigators said, Barry was using much of the money to speculate on real estate. He bought an office building in Brooklyn and big tracts of undeveloped land upstate.

Authorities said he hid the scheme by feeding his customers financial statements boasting of hefty profits that didn’t exist. Sounds familiar, Madoff used the same tactics.

Some of the cash was used to pay for Mr. Barry’s own expenses at restaurants and petrol stations and to maintain the approximately 60 properties he had bought, prosecutors said.

Other funds were diverted to a mail-order business called Barry Publications, which sold pornographic materials

“It’s all in real estate,” Barry said. “I’m going to keep on working to make sure everyone gets the profit they are entitled to.”

Investors have sued Mr. Barry for the return of their cash but are unlikely to receive the bulk of it back. The properties owned by Leverage Group are thought to be worth slightly over $1 million in total. At least 19 of the properties are in foreclosure.

How did this all happen? A promise of high returns on investment, promising 12% to 20% return on money invested. If it’s too good to be true, it’s not true. People’s greed gets them every time.