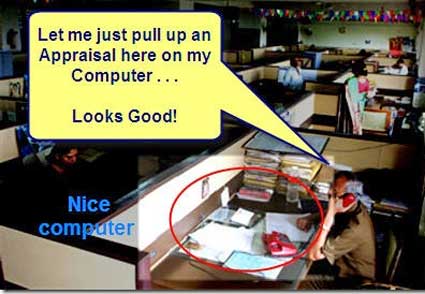

Photo courtesy of Red Clay Media

Despite Federal Reserve regulations that took effect April 1 requiring lenders to pay appraisers fair fees, many appraisers say they are still offered $200 to $250 by lenders for work billed to consumers at $450 or more.

- Last year’s Dodd-Frank financial reform law mandated that appraisers receive fees that are “customary and reasonable” for their local market areas, yet the Appraisal Institute says that is not happening.

- While a portion of the difference between what consumers are billed and appraisers are paid goes to the management companies that connect lenders with local appraisers and take a percentage for their services, often times lenders make a profit from the appraisal as well.

- Home buyers should care about this for several reasons. For starters, accurate appraisals are a concern for consumers, as appraisals can be deal-breakers if the appraisal comes in too low. When performed competently, appraisals can be accurate measures of the equity in a home when the homeowner refinances or seeks a second mortgage.

- Most experienced independent appraisers refuse to work for $200 to $250 because they can’t pay their overhead at that rate, leading less-experienced appraisers, who sometimes travel long distances and are unfamiliar with the area, to conduct the appraisal, which can lead to inaccurate, appraisals.

- The Appraisal Institute is seeking to persuade the Federal Reserve to tighten its regulations, which created a loophole for lenders and management companies that wanted to keep paying low fees to appraisers. In the meantime, consumers should demand transparency, asking how the appraisal fee was distributed and why.

For all your real estate needs call or email

John J. O’Dell

Real Estate Broker

O’Dell Realty

(530) 263-1091

Email jodell@nevadacounty.com

DRE# 00669941