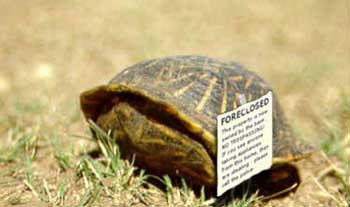

Zombie foreclosures are still haunting the housing market, representing one in every five foreclosures nationally, according to RealtyTrac, a housing data firm. “Zombie foreclosure” is a term coined to describe properties where the foreclosure process has been started and the home owner vacates, but the foreclosure has never been completed. As such, the distressed home owners who vacate eventually find they still own the home, and are often unaware they are still responsible for it.

Find out how the Consumer Financial Protection Bureau is targeting zombie foreclosures.

The vacated properties can become eyesores in neighborhoods and drive down nearby property values. They also take a big chunk out of local government revenue in the form of unpaid property taxes. RealtyTrac estimates that more than $400 million in property tax revenue is likely delinquent due to zombie foreclosures. Still, the zombie foreclosure rate has shown some improvement, falling 7 percent compared to the first quarter of this year and dropping 16 percent from year-ago levels.

Florida has the highest number of zombie foreclosures, accounting for more than one-third of all zombie foreclosures nationwide. New York, New Jersey, Illinois, and Ohio also have some of the highest numbers of zombie foreclosures across the country.

“Most of these states have seen an increase in new foreclosure activity over the past year, creating a more fertile breeding ground for zombie foreclosures,” says Daren Blomquist, vice president at RealtyTrac.

Some states, such as Florida and Illinois, are looking to combat zombie foreclosures by weighing legislation that could help “fast track” foreclosures and move the abandoned properties through the system more quickly, RealtyTrac reports. New York is also considering legislation that would make lenders responsible for the upkeep of zombie foreclosures. Some local governments—such as in Cleveland and Detroit—also are creating land banks that would include zombie foreclosures, allowing city officials to rehab properties or demolish them.

Where Zombie Foreclosures Are Highest

On a metro level, the seven markets with the highest number of zombie foreclosures, according to RealtyTrac’s second quarter report, are:

- New York-Northern New Jersey-Long Island, N.Y.-N.J.-Pa.

- Miami-Fort Lauderdale-Pompano Beach, Fla.

- Chicago-Naperville-Joliet, Ill.-Ind.-Wis.

- Tampa-St. Petersburg-Clearwater, Fla.

- Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md.

- Orlando-Kissimmee, Fla.

- Jacksonville, Fla.

Meanwhile, California posted the largest drop in zombie foreclosures, down 57 percent in the past year. Other states posting large decreases are Arizona, Nevada, and Washington.

Help me keep this website going

Call today for buying or selling real estate

John J. O’Dell Realtor® GRI

O’Dell Realty

(530) 263-1091

Email John

BRE#00669941